10 Ways to Copy How Celebrities Save Money - Como Poupar Dinheiro, Aprenda com as Celebridades e Bilionarios:

10 Ways to Copy How Celebrities Save Money

Too often we read about people who spend money, lavishing millions on homes, cars, paintings and outrageously priced bottles of wine. Hardly a day passes without our reading about another celebrity shopping spree — Kim Kardashian and her mom dropping $100,000 on Hermes handbags, Britney Spears, after her parents separated, spending $5.4 million on an estate for her mom, or the former first lady of extravagance, Imelda Marcos, blowing half her Philippine nation’s GDP on her 3,000-plus shoe collection.

Just as fascinating, however, is discovering how celebrities save money — in particular, how they amassed their fortunes in the first place. We want to know what precisely put them on the path toward riches and influenced their savings habits. For some, the savings experience might have been as simple as collecting their parents’ spare pennies and rolling them into little brown wrappers. Others may have started their fortunes by collecting empty soda bottles left behind on the beach and exchanging them at their local liquor store for the nickel or dime deposit they earned. When legendary investor Warren Buffett was 14, he parlayed the savings from his paper route into the purchase of 40 acres of farmland, which he rented out.

So while we might be dazzled by what’s next on Victoria Beckham’s shopping list, we might be better served by emulating some celebrity “super-savers.”

In that spirit, join us for a peek into the attitudes, values, principles and perspectives of some of the frugally famous. Not all of our “celebrities” are common names or even currently alive, but after finding out who they are, you’ll agree they should be widely celebrated during any age for their uncommon thrift and the unique ways they compiled their fortunes.

Here then are 10 of our favorite savings heroes and some of their savings habits that you can apply to your own life to bolster your savings.

1. Ben Franklin (1706-1790)

Benjamin Franklin is the poster child for thrift and savings, which might be why he graces our $100 bill. The author of “The Poor Man’s Almanac,” and sayings like, “Beware of little expenses; a small leak will sink a great ship,” he practiced what he preached, even in death.

In Ben Franklin’s will, he left $5,000 to the city of Boston, his birthplace, with instructions that the sum stay untouched for 100 years. When accessed a century later, the bequest was worth $420,080, an amount matched by philanthropist Andrew Carnegie. Boston used the bulging bank account to build the Franklin Institute of Technology, a two-year college that today boasts a graduation rate three times the national average.

Takeaway: Like Ben, put your money in a long-term CD, and just forget about it while the power of compounding works its magic. For a quick gauge on how quickly it will take to double your money, use the Rule of 72, which tells you to divide 72 by whatever interest rate you’re receiving. So, if you invest $5,000 in a CD at 6 percent (divide 72 by 6), you’ll have about $10,000 in 12 years years.

2. Jay Leno

Jay Leno might be a comedian but he’s very serious about saving money. He’s practically a billionaire in blue jeans. His secret … when he’s working two jobs, he lives on one salary. In his youth, working at both McDonald’s and a Ford dealership, the industrious Leno would spend the money from the one job and save the money from the other. Later, as the host of “The Tonight Show,” he banked his TV money and lived only on the income from his weekend comedy gigs.

Takeaway: If you can handle it, two jobs might be the way to super-charge your savings. If you find yourself making too much money, shelter some of it by opening a tax-deferred IRA and participating in your company-sponsored 401(k).

3. John D. Rockefeller (1839-1937)

Flickr source

Rockefeller, who co-founded Standard Oil, America’s first trust, believed one of the best ways to save is to keep track of what you spend. “Keep a little ledger, as I did,” he said. “Write down in it what you receive, and do not be ashamed to write down what you pay away. See that you pay it away in such a manner that your father or mother may look over your book and see just what you do with your money. It will help you to save money, and that you ought to do.”

His contemporary, Thomas Edison, also had a knack for writing things down. At the time of his death, Edison had 2,500 notebooks, filled with facts about the problems he was facing. “Opportunity is missed by most people because it is dressed in overalls and looks like work,” Edison said.

Takeaway: Granted, it’s work to take copious notes and make daily accountings, but your records will come in handy if you’re ever audited by the IRS. Also, by keeping close watch over your money, you’ll be less apt to spring any of those “leaks” that Franklin warned of. Finally, by writing down your savings plan and going over it with your local banker, financial adviser, or even mom and dad, you’ll be more committed to it.

4. Kemmons Wilson (1913-2003)

Flickr source

If you don’t overpay for things, you’ll have more left over for savings. If you ever feel a seller’s price is too high, don’t pay it or resolve to pay it that one and only time, and never pay it again. Consider the case of Kemmons Wilson. On vacation in 1951, Wilson and his wife Dorothy, and their five children stopped at a roadside motel to spend the night. After the innkeeper told him it was $6 for the room and an additional $2 per child, Wilson was fuming, declaring to his wife, “I’m going to start a hotel where kids stay free.” A year later, Wilson opened the first Holiday Inn in Memphis, Tenn., naming it after the 1942 musical film starring Bing Crosby and Fred Astaire. In 2014, Holiday Inn is still advertising “Kids Stay and Eat Free.”

Takeaway: Know your spending limit and stick to it.

5. Ralph Bruno

Flickr source

Treat leftovers as the gold they sometimes are. That was Ralph Bruno’s mantra. A quarter century ago, Bruno was reupholstering his mother’s living room furniture when he found himself with a leftover cushion. Rather than dump it in the trash, he burned a hole in it, painted it a cheesy yellow and stuck it on his head. He was America’s first official Cheesehead, which until that crowning moment was a derogatory term that Chicago Bears fans called Green Bay Packers fans. Bruno had the audacity to wear his cheesy hat to a baseball game between Milwaukee Brewers and the Chicago White Sox. Today, he is the the self appointed “Father of Fromage” and owner of Foamation Inc., a multimillion dollar business that sells cheesehead products in all 50 states and 30 nations around the globe.

Takeaway: Boost your savings by holding a garage sale or converting your leftover junk into the next hot seller. Most banks let you open a savings account with just $25, so post your garage sale signs around town and be ready to head to the bank on Monday. Of course, if you hit it big, you might need to talk to your savings institution’s wealth management adviser.

6. Oseola McCarty (1908-1999)

Oseloa McCarty wasn’t as rich as Rockefeller but she has earned a place in our pantheon of savers on style points alone, demonstrating it’s not how much you make, but how much you save that separates the savings winners from the losers. She was a sixth grade dropout from Hattiesburg, Miss. Despite being a washerwoman most of her life, she still managed to open several savings accounts around town. She had the money to invest by scrimping and saving wherever and however she could. She never owned a car and walked everywhere she went, pushing a shopping cart nearly a mile to get groceries. She rode with friends to attend services at the Friendship Baptist Church. She did not subscribe to any newspaper, considering that expense one more extravagance.

When she died, her thrift drew national headlines because she endowed the University of Southern Mississippi with $150,000, plus gave $50,000 to her church and another $50,000 for three relatives to divide.

Takeaway: It’s fun to spread your wealth around. Also be aware that the standard insurance is $250,000 per depositor, per insured bank, for each account ownership category.

7. Howard Schultz

Before dipping into or depleting your own savings, use other people’s money (OPM) if you want to grow your business. That’s exactly what current Starbucks CEO Howard Schultz did. In the early 1980s, he needed to raise $400,000 for his start-up and another $1.25 million for opening eight espresso bars. Of the 242 potential investors he approached, 217 turned him down. His father-in-law was one of those not keen on his entrepreneurial venture. “… We were going for a walk and he said let’s sit down,” Schultz recalled. “We sat on a park bench and he said to me with my daughter seven-eight months pregnant and still working, and you not bringing in a salary, I want to ask you to do something, and that is to give up this dream and hobby and get a job. And I remember I started to cry because I was so embarrassed. But I couldn’t do it.” Today, Starbucks has a market cap of about $56 billion.

Takeaway: There are literally thousands of people who would love nothing more than to invest in your great idea. Actually, funding a project or start-up yourself is taking the easy way out. When people invest in you — even if you have to talk to 242 people to find 25 willing partners — you receive validation or proof of concept that your idea is indeed a good one.

Takeaway: Instead of raiding your 401(k) or IRA and potentially enduring a tax penalty, get others to share your vision. Use kickstarter.com and other social media sites to solicit financial help.

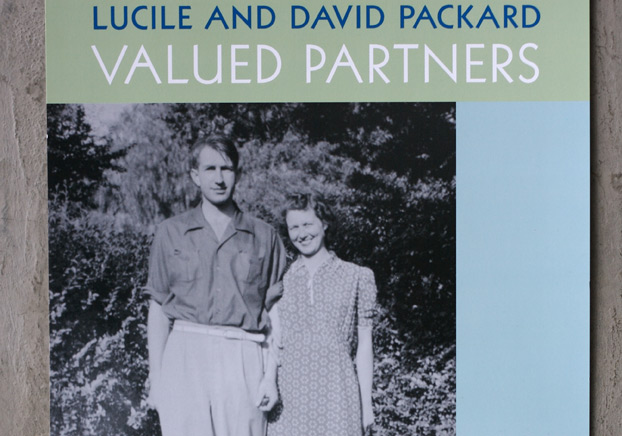

8. David Packard (1912-1996)

Flickr source

David Packard personified cash, not flash. The self-effacing leader and co-founder of tech giant Hewlett Packard lived in the same simply furnished house at 367 Addison Avenue in Palo Alto, Calif., with a tiny kitchen and linoleum floor, from 1957 until his death in 1996. He left his $5.7 billion estate to his foundation. Today his humble home is considered the birthplace of the Silicon Valley.

Takeaway: Like Warren Buffett, who also lived in his same home since 1958 for which he paid $31,500, you shouldn’t feel pressured to always be upsizing to keep up with your neighbors. There are better ways to see your money grow than thinking of your home as a real estate investment. Even Buffett has admitted that he would be far richer today had he decided to rent instead of buy back in 1958. See for yourself. Today, Buffett’s house is valued at about $700,000. That’s a nice gain from his initial investment. But if he had invested that same $31,500 in the market, figuring an 8 percent gain over the last 56 years, he would have more than $2.7 million.

9. Mark Zuckerberg

Flickr source

Facebook founder Mark Zuckerberg is cut from the same cloth as many of our other famous savers. He lives in a home well below his means, drives a safe, ho-hum Acura, dresses in a gray t-shirt and hoodie and got married in his backyard. Despite this spartan lifestyle, he’s always thinking of ways to earn more money, which in turn means you should be able to bank more money. A few hours after Facebook filed to go public (Feb. 1, 2102, a photo was posted on Zuckerberg’s Facebook page, showing an open Mac laptop, a yellow Gatorade bottle, and a sign on his desk that read, “Stay focused and keep shipping.”

Takeaway: Parkinson’s law states that as you make more money, your spending and expenses also will increase. That law, however, doesn’t have to apply to you. Just because you can afford to pay more for everything, doesn’t mean you should. So, continue to turn of, lights as you exit rooms, take shorter showers, refill your plastic bottles, and continue to conserve life’s precious resources, of which money is one. And keep shipping!

10. Troy Caldwell

Meet the world’s richest parking lot attendant. About 20 years ago, Troy Caldwell bought 430 acres between the Squaw Valley and Alpine ski areas in Lake Tahoe, Calif., for less than a half million dollars. To make the purchase, Caldwell liquidated everything he owned, including his home, then moved onto the property, where he lived in a trailer without electricity or running water for six years. In 2012, Caldwell turned down a $45 million offer for his property from Squaw Valley Ski Holdings, which wants to build a chair lift that would cut across his land and connect the company’s two resorts. Although a multi-millionaire on paper, Caldwell earns only about $50,000 to $60,000 a year doing odd jobs, including parking cars and shuttling skiers between the two resorts in his personal truck. Instead of selling or partnering with investors with whom he would have to share control, Caldwell wants to build his own ski resort, which he figures will take him another 10 to 15 years to complete.

Takeaway: Ask yourself what you can liquidate to bolster your savings and give you more financial flexibility. With your savings, think long-term by letting your account compound daily in a savings account, CD or IRA. Also, try to keep your debt to a minimum. “I own everything,” Caldwell said. “I don’t have any mortgages. We’re able to make $50,000, $60,000 kind of work for us. If I get a lot of cash in my wallet, it’s not good when I’m driving my car because it bothers my back.”

Comments

Post a Comment